Understanding GAP Insurance

My Personal Journey with GAP Insurance

Four years ago, when I first bought my car, I did not even know what GAP insurance meant. I thought that my standard coverage would protect me in every situation. Yet, life has a way of teaching lessons in the most unexpected ways. I watched friends struggle after accidents, their cars totaled, and their insurance barely covering what they owed. That is when I realized the depth of GAP insurance. GAP, short for Guaranteed Asset Protection, is a type of insurances designed to cover the gap between what a car is worth and what a car owner still owes on their auto loan. Without it, even a minor accident can become financially devastating.

How GAP Insurance Works

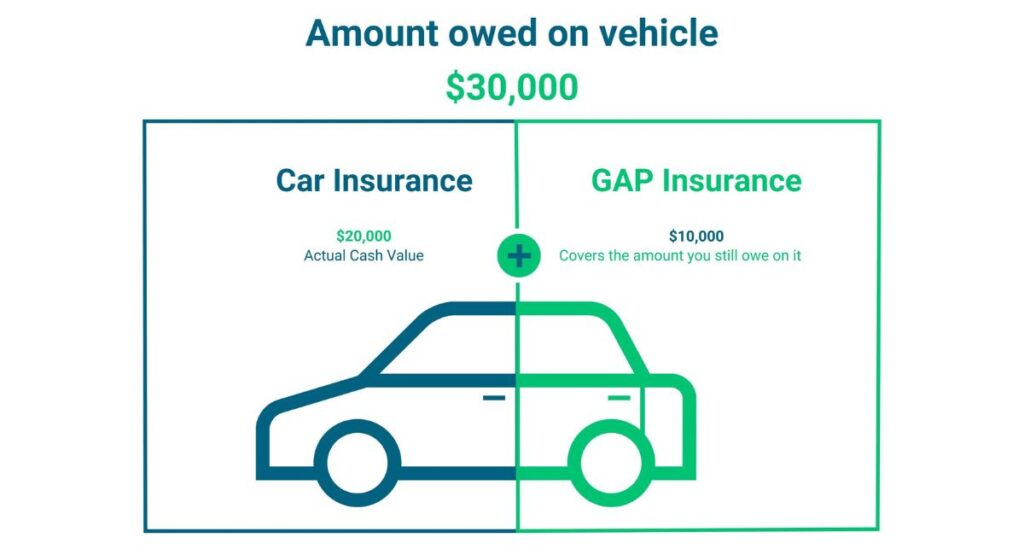

GAP insurance works in a way that feels like a safety net, carefully woven from the threads of protection and peace of mind. Imagine having a car accident on a rainy evening, and the total loss leaves you owing thousands more than your car’s depreciated value. This gap is precisely what GAP insurance addresses. In my own experience, after researching extensively and speaking to experts, I realized how many people overlook this coverage, assuming regular insurances are enough. They are not. GAP insurance is a thoughtful shield that ensures financial stability during turbulent moments in life.

Why GAP Insurance Matters

In the stories I have collected over the years, I have seen the heavy weight of financial stress when a car loan is still active but the vehicle is gone. GAP insurance is not just a policy; it is a lifeline. It bridges the emotional and financial gap when the unexpected strikes. By protecting the amount owed beyond standard coverage, it allows people like me, and perhaps you, to continue life without bearing the burden alone. For more details about various insurance options, I found Insurances Wala an invaluable resource.

Benefits of GAP Insurance

Financial Peace of Mind

When I finally added GAP insurance to my coverage, I felt a calm I had not expected. The first accident that involved a total loss came within months, and while it was a stressful day, my financial anxiety was minimal. Standard insurances often leave a remaining balance that can weigh heavily on one’s mental and emotional well-being. GAP insurance ensures that there is no extra financial burden.

Protection Beyond Standard Policies

In my research and personal conversations, I realized that insurances like collision and comprehensive cover the current market value of a vehicle. They do not account for depreciation or remaining loan amounts. GAP insurance fills this crucial gap. This coverage is particularly important for leased cars or new vehicles that depreciate rapidly. Every time I shared my story with friends or family, they were surprised by how GAP insurance could prevent such hidden losses.

Peace of Mind in All Situations

No one can predict when accidents happen. I have seen minor fender benders escalate into financial crises simply because the insurance policy did not cover the difference. GAP insurance is an emotional anchor, allowing people to navigate life without constant worry about what happens if their vehicle is totaled. For a detailed guide to GAP and other insurances, I regularly refer to Insurances Wala and have found it to be a deeply trustworthy source.

How to Choose the Right GAP Insurance

Assessing Your Needs

When I began choosing GAP insurance, the first step was introspection. What kind of car do I own? How much do I still owe on it? What is my risk tolerance? Evaluating these factors carefully can determine the type of coverage needed. GAP insurance is not one-size-fits-all; it must align with your financial reality and emotional comfort.

Comparing Policies

Over the years, I have learned that comparing different providers and reading every clause is essential. Some policies cover only the loan balance, while others also include deductibles or add-ons like rental coverage. This nuanced understanding ensures that insurances provide the protection they promise.

Finding Trusted Resources

During my journey, one of the most helpful things was consulting trusted platforms. Insurances Wala provided comprehensive explanations, comparisons, and examples that helped me make an informed choice. By combining personal experience with research, I found a policy that truly safeguarded my finances and peace of mind.

Real-Life Stories of GAP Insurance in Action

The Friend Who Needed It Most

A few years ago, one of my closest friends faced a devastating accident. Her brand-new car was totaled within the first year of purchase. Without GAP insurance, she would have owed thousands more than the insurance payout. Watching her struggle made me realize that this coverage is not just a financial tool, but a shield for emotional well-being. GAP insurance allowed her to move forward without debt, and seeing her relief made me understand why this coverage is so essential.

Lessons Learned From Observation

Over time, I observed patterns. Many people assume that their standard insurances are sufficient, only to face shocking shortfalls after a total loss. The emotional stress of unexpected financial obligations often surpasses the inconvenience of losing a vehicle. GAP insurance mitigates this, providing a buffer between fear and reality. My research and personal experience consistently reinforced the lesson: the peace of mind offered by GAP insurance is invaluable.

How GAP Insurance Supports Everyday Life

Even outside of accidents, GAP insurance provides a psychological safety net. I have personally noticed that knowing this coverage exists reduces daily anxiety. Driving in heavy traffic, navigating winter roads, or simply parking in crowded areas becomes less stressful when I know that a worst-case scenario will not cripple me financially. This emotional relief is often overlooked but forms a critical part of the value of insurances like GAP insurance.

Choosing the Right Provider for GAP Insurance

Trust and Transparency Matter

During my search for the right GAP insurance provider, one thing became clear: trust is everything. Policies may seem similar, but hidden clauses can create gaps in coverage. I relied heavily on detailed resources and personal research to find a provider that offered full transparency. Reading reviews, asking questions, and examining policy documents made a significant difference.

Personal Experience With Providers

From my own experience, some providers add value by including extra coverage, such as rental cars or loan interest, while others focus strictly on the loan-vehicle gap. Understanding these nuances requires time, but the investment in effort pays off. Platforms like Insurances Wala provide honest comparisons and real-life examples that help navigate this complex landscape.

Balancing Cost and Coverage

One of the biggest concerns I have encountered is cost. Many people hesitate, assuming GAP insurance is too expensive. My experience shows that the cost is relatively minor compared to the financial protection it offers. By comparing different options, evaluating needs, and considering potential scenarios, choosing the right policy becomes a balance between affordability and comprehensive coverage.

Emotional and Practical Impact of GAP Insurance

Reducing Stress in Crisis Moments

Four years of observing families, friends, and my own experiences with accidents have taught me that the emotional impact of financial surprises can be heavier than the accident itself. GAP insurance acts as a cushion, absorbing the shock and letting people focus on recovery, not debt.

Encouraging Responsible Financial Planning

GAP insurance also encourages mindful financial behavior. It taught me to think ahead, consider depreciation, and plan for unexpected events. The lessons extend beyond insurance; they influence budgeting, saving, and long-term financial security.

Stories That Inspire

I met a young couple whose first car was totaled in a storm. Thanks to GAP insurance, they were able to pay off the remaining loan and even save for a replacement without financial strain. These stories reinforce the deeper meaning of GAP insurance: protection, resilience, and peace of mind.

Common Misconceptions About GAP Insurance

GAP Insurance is Only for New Cars

Many people believe that GAP insurance is only useful for brand-new vehicles. I learned the hard way that depreciation can affect cars of any age. Even cars that are one or two years old may have a significant difference between their value and the remaining loan, making GAP insurance relevant.

Standard Insurance Covers Everything

Another common misconception is that collision or comprehensive coverage will suffice. I have spoken to countless individuals who assumed this, only to face shocking bills after a total loss. GAP insurance is the bridge that prevents financial disasters when other policies fall short.

GAP Insurance is Expensive

While some believe GAP insurance is costly, my personal experience showed otherwise. The small premium relative to the potential financial loss is minimal. It is an investment in stability, peace of mind, and protection against the unpredictable.

Understanding the Emotional Value

Insurance is often viewed purely in financial terms. In my observation, GAP insurance provides emotional security, alleviating stress during one of life’s most unsettling moments. The peace of knowing that a total loss will not destroy financial stability is priceless. For anyone looking for more insights, Insurances Wala is a remarkable platform that explains these nuances beautifully.

Conclusion

Over four years, I have witnessed how GAP insurance can transform the way we approach risk and responsibility. It is not just a policy but a lifeline, a bridge between uncertainty and security. From personal experiences to countless conversations, the lesson is clear: investing in GAP insurance is an act of self-care, foresight, and emotional resilience. Life is unpredictable, but with the right protection, the unexpected does not have to be catastrophic.

FAQs

1. What is GAP insurance?

GAP insurance, or Guaranteed Asset Protection, is a policy that covers the difference between what your vehicle is worth and the remaining balance on your loan or lease if your car is totaled or stolen.

2. Who needs GAP insurance?

Anyone with an auto loan, especially new or leased vehicles, can benefit. It is particularly useful when the car depreciates faster than the loan is paid off.

3. Does GAP insurance cover deductibles?

Some policies do cover deductibles, but it depends on the provider. Always read the policy carefully to understand the coverage.

4. Is GAP insurance expensive?

GAP insurance is generally affordable, with premiums often costing a fraction of potential financial losses. It is considered a small investment for significant peace of mind.

5. Can I buy GAP insurance after purchasing a car?

Yes, most providers allow it within a certain period after purchase. Timing is crucial to ensure maximum benefit.

6. Does GAP insurance replace standard auto insurance?

No, GAP insurance complements existing coverage. It fills the gap between your vehicle’s value and the remaining loan, while standard insurance covers the current value.

7. How do I choose the right GAP insurance?

Assess your car’s value, loan balance, and personal risk. Compare policies and consult trusted resources like Insurances Wala for guidance.