Introduction

In today’s digital world, businesses are becoming more dependent on technology than ever before. Data, systems, and online platforms are now the backbone of daily operations. However, with this growing reliance comes a rising level of risk. Cyberattacks are increasing in number, size, and complexity. Hackers are targeting companies of all sizes, not just large corporations. This is where cyber insurance becomes an important part of modern business protection.

Many organizations believe that strong security tools alone are enough to stop cyber threats. While security solutions like Silverfort help in protecting identities and access points, no system is completely immune to attacks. A single mistake, weak password, or insider threat can open the door to serious damage. When a cyber incident happens, the cost is not only financial. It also affects trust, reputation, and long-term growth. Cyber insurance helps businesses manage these risks by providing financial and operational support after a cyber event.

Cyber insurance coverage works as a safety net. It helps organizations recover from losses caused by data breaches, ransomware attacks, system failures, and other cyber incidents. With Silverfort’s identity security capabilities and proper cyber insurance coverage, businesses can create a stronger and more balanced defense strategy. This combination focuses not only on prevention but also on recovery.

Another important point is that cyber laws and compliance requirements are increasing across the world. Businesses are expected to protect customer data and respond quickly to security incidents. Failure to do so can result in heavy fines and legal trouble. Cyber insurance helps organizations meet these responsibilities by covering legal costs, investigation expenses, and regulatory penalties.

In simple terms, cyber insurance is no longer optional. It is becoming a necessity for businesses that want to survive and grow in a digital environment. When combined with advanced security platforms like Silverfort, it offers both protection and peace of mind. This article explains cyber insurance coverage in detail, focusing on how Silverfort fits into this picture and why businesses should take cyber insurance seriously.

Understanding Cyber Insurance Coverage with Silverfort

Cyber insurance coverage is designed to support businesses when cyber incidents occur. Silverfort strengthens identity security, while cyber insurance helps manage the financial impact of attacks. Together, they create a layered approach to cyber risk management.

The Role of Identity Protection in Cyber Insurance

Identity is often the main target in cyberattacks. Hackers try to steal credentials to gain unauthorized access. Silverfort protects identities across systems, and cyber insurance supports recovery when identity-based attacks still succeed. Cyber insurance is important because even strong identity controls cannot guarantee zero risk.

When identity protection and cyber insurance work together, businesses are better prepared. Cyber insurance is useful when identity breaches cause data loss or system downtime. This support helps organizations respond quickly and reduce damage.

How Silverfort Supports Cyber Insurance Requirements

Many insurance providers now require businesses to meet certain security standards. Silverfort helps organizations meet these conditions by improving access control and visibility. Cyber insurance providers often look for strong identity security before offering coverage.

Silverfort improves security posture, which can reduce cyber insurance premiums. Cyber insurance is more affordable when risks are controlled. This relationship benefits both insurers and insured companies.

Why Businesses Combine Silverfort with Cyber Insurance

Businesses choose Silverfort and cyber insurance together because prevention alone is not enough. Cyber insurance is needed when prevention fails. Silverfort reduces attack chances, and cyber insurance reduces financial loss.

This combination creates balance. Cyber insurance is a financial shield, while Silverfort is a technical shield. Both are necessary in today’s threat environment.

Types of Cyber Insurance Coverage for Modern Businesses

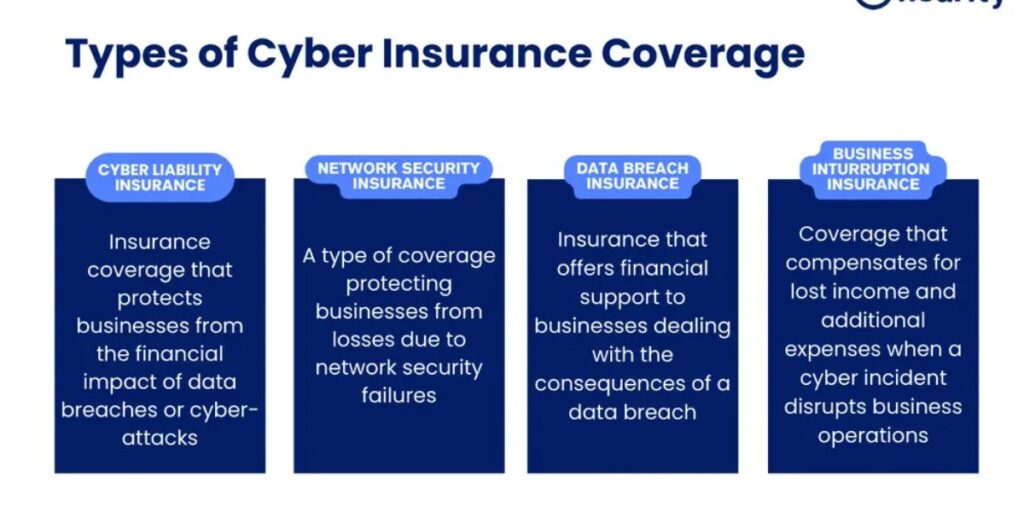

Cyber insurance is not one-size-fits-all. Different policies cover different risks. Understanding these types helps businesses choose better protection while working with Silverfort.

First-Party Coverage in Cyber Insurance

First-party coverage focuses on direct losses faced by the business. Cyber insurance helps cover costs like data recovery, system repairs, and business interruption. When systems go down, cyber insurance helps maintain stability.

This type of cyber insurance is critical because downtime can stop operations completely. Silverfort reduces attack success, but cyber insurance helps when downtime still occurs.

Third-Party Coverage and Legal Protection

Third-party coverage handles claims made by customers or partners. Cyber insurance covers legal defense costs and settlements. This is important when data breaches expose personal information.

Silverfort limits unauthorized access, but cyber insurance protects businesses from legal consequences. Cyber insurance ensures that companies can handle lawsuits without financial collapse.

Ransomware and Extortion Coverage

Ransomware attacks are increasing rapidly. Cyber insurance often covers ransom payments, negotiation services, and recovery costs. Silverfort helps prevent lateral movement, but cyber insurance supports recovery.

- Below are key benefits of ransomware-related cyber insurance:

- Covers ransom negotiation and payment support

- Helps restore systems and data after attacks

- Reduces financial pressure during crises

- This form of cyber insurance is especially valuable for businesses handling sensitive data.

- Benefits of Cyber Insurance When Used with Silverfort

Cyber insurance becomes more effective when combined with strong security controls. Silverfort enhances identity protection, and cyber insurance strengthens recovery.

Financial Stability Through Cyber Insurance

Cyber incidents can cost millions. Cyber insurance helps businesses stay financially stable after attacks. Without cyber insurance, recovery can take years.

Silverfort reduces incidents, but cyber insurance ensures survival when attacks succeed. Cyber insurance supports operational continuity.

Improved Incident Response and Recovery

Most cyber insurance policies include access to expert response teams. These teams help investigate and resolve incidents quickly. Cyber insurance is valuable because speed matters.

Silverfort provides detection, and cyber insurance provides response. This teamwork reduces long-term damage.

Regulatory and Compliance Support

Regulations require fast reporting of breaches. Cyber insurance helps cover compliance costs and fines. Silverfort improves access monitoring, but cyber insurance manages legal impact.

Below are common compliance-related benefits of cyber insurance:

- Covers regulatory fines and penalties

- Supports audit and investigation costs

- Helps manage notification requirements

- Cyber insurance ensures that compliance failures do not destroy businesses.

- Choosing the Right Cyber Insurance Coverage Strategy

Selecting the right cyber insurance strategy requires planning and understanding. Silverfort plays a role by reducing risk and improving eligibility.

Assessing Business Risk Levels

Every business has different risks. Cyber insurance should match these risks. Companies using Silverfort often qualify for better cyber insurance terms.

Risk assessment helps choose appropriate cyber insurance coverage. This step is essential.

Aligning Security Controls with Insurance Needs

Insurance providers look for strong controls. Silverfort strengthens identity security, which improves cyber insurance approval chances. Cyber insurance is easier to obtain when controls are strong.

Alignment between security and cyber insurance is important for long-term success.

Long-Term Planning with Cyber Insurance

Cyber threats evolve constantly. Cyber insurance policies should be reviewed regularly. Silverfort updates security posture, and cyber insurance updates financial protection.

Long-term planning ensures that cyber insurance remains relevant and effective.

Conclusion

Cyber threats are no longer rare or unexpected. They are a daily reality for businesses operating in a digital environment. As technology continues to grow, so do the risks associated with it. This is why cyber insurance has become an essential part of modern business protection. When companies combine strong security solutions like Silverfort with the financial protection of cyber insurance, they create a balanced and resilient defense strategy.

Silverfort focuses on identity security, which is one of the most targeted areas in cyberattacks. It helps reduce unauthorized access and limits the spread of attacks inside networks. However, no security solution can guarantee complete protection. This is where cyber insurance plays a vital role. It supports businesses during recovery, helps manage legal responsibilities, and reduces financial stress after incidents.

Another important benefit of cyber insurance is peace of mind. Business owners can focus on growth instead of constantly worrying about cyber risks. With proper planning, companies can choose cyber insurance policies that match their size, industry, and risk level. Regular reviews and updates ensure that coverage remains effective as threats change.

Cyber insurance is not just about money. It also provides access to expert support, incident response teams, and compliance assistance. These services help organizations respond quickly and professionally to cyber incidents. When paired with Silverfort, businesses gain both prevention and recovery capabilities.

In conclusion, cyber insurance is no longer optional in today’s digital world. It is a necessary tool for protecting operations, reputation, and long-term success. Companies that invest in both advanced security and cyber insurance are better prepared for the challenges of the future. This approach ensures stability, confidence, and resilience in an increasingly connected world.

Frequently Asked Questions (FAQs)

1. What is cyber insurance and why is it important?

Cyber insurance is a type of coverage that helps businesses recover from cyber incidents. Cyber insurance is important because it reduces financial and legal risks after attacks.

2. How does Silverfort support cyber insurance coverage?

Silverfort improves identity security, which lowers risk. This makes cyber insurance easier to obtain and more effective.

3. Does cyber insurance cover ransomware attacks?

Yes, many policies include ransomware coverage. Cyber insurance helps with ransom payments, recovery, and expert support.

4. Is cyber insurance suitable for small businesses?

Yes, small businesses also face cyber risks. Cyber insurance helps protect them from costly incidents.

5. Can cyber insurance reduce business downtime?

Yes, cyber insurance supports fast recovery and incident response, which reduces downtime.

6. How often should cyber insurance policies be reviewed?

Policies should be reviewed annually. Cyber insurance must stay aligned with changing risks and business needs.